Yo! As always, thanks for checking in. Let’s talk about REAL Money. First of all, we are not financial advisors, but we thought we’d share some ideas we found to be useful when dealing with money. REAL Money is made and spent strategically. We noticed that money isn’t talked about in school, until (maybe) college. We also noticed that people outside of school don’t educate people about money until it’s too late. The problem is that if nobody is teaching our culture about how to make and spend money, we might end up doing things that are counterproductive to make money, then spend it on things that are unnecessary and have little value.

The Purpose of REAL Money

It’s important to start this off by discussing the purpose of money. We need to put money in its place. Let’s keep it REAL, money is a green piece of paper with letters and numbers on it. It’s simply a resource to get what we want. That’s it! Let’s think about a funny concept: If we are all chasing money, then why is money running away from us? Think about it. We need to change our perspective on money. It is meant to be made and spent. It’s not this beautiful mirage that can never be obtained. If we understand the purpose of money, we can understand how to use it. Also, if we have the right mindset (check out REAL Talk #8), then we will understand that money should work for us. Simple as that. Before we dive into some of our strategies about how to make and spend REAL Money, it’s very important to know the end-goal. How much money do you need for what you want? A simple question that will help you more than you realize. Always begin with the end-goal in mind. By having the end-goal in mind, you can figure out the steps you need to achieve that goal. Again, since money is a resource, the goal should be something other than money (unless you plan on creating generational wealth for your family, of course). Ultimately, life goals (i.e., love and happiness) are and should be separate from money goals.

Earning REAL Money

Let’s start with this: Illegally earning money is counterproductive and unnecessary. There are too many ways to make money without the worry of getting arrested or getting killed, which leads to other financial burdens (not only for you, but for your family). Now that we’ve got that covered, let’s move on. Making REAL Money is, again, a strategic process. After you’ve created the financial end goal, it’s time to figure out what you are willing to do for free. This could be anything from art to taxes. Whatever it is, as long as you don’t mind the work (or actually enjoy it), it can lead to some REAL Money if you’re able to figure out how to make money doing it. People who typically master this technique are extremely successful. Let’s keep it REAL, these people are usually the billionaires of the world because they would be doing what they love regardless of if they’re getting paid or not so they’re always “working” which means they’re always getting paid. This strategy is the least strategic, but the most rewarding. We recommend, if needed, to couple this strategy with another part-time job until you can make what you love your full-time job. By the way, the more sources of income you have, the better. So, if you’re able to figure out multiple ways to make money doing what you love, the quicker you’ll get to that billionaire class.

Passive income

Imagine you’re sitting on the beach just listening to the water crash against the sand. Before you know it, you’ve fallen into a deep sleep. You have a dream about being inside a whale. You do a freak-out flinch and wake up. You wipe your forehead thankful it was just a dream. You check your phone and see you’ve just made $2500 while you were sleeping. It’s NOT a dream! This is how having passive income feels and yes, YOU can have this same feeling. The beautiful thing about passive income is that you don’t have to work to make the money. There are other ways the work is being done. We recommend doing some research on ways you can make passive income, and the 4-hour Work Week by Tim Ferris is a great place to start! We promise you won’t regret the decision to start the passive income journey. If you can find a way to minimize the amount of time you have to work and maximize the profit you make during your time, you’re earning REAL Money. Again, these people are the billionaires. Let’s Keep it REAL, you can try to give yourself more, but there’s just not enough time in the day for one person to make that much money. It takes some dedication to start earning enough passive income to completely stop working, but if you couple this strategy with something you already love to do, you’ll be happy you decided to start. You can thank yourself later.

REAL Budget Plan

You’ve probably heard about this strategy countless times, but we thought we would explain this differently. A REAL budget plan is a place that has your income and expenses. This could be hand-written or digital. The unique approach to a REAL budget plan is that as you document your income and expenses, you’ll also document what you plan to do with the income or how the expense is saving or growing your money (we will discuss saving and growing your money further in the next section). By doing this, you are holding yourself accountable to a plan of what that money will do for you. This is where strategy comes into place. You are using your resource (money) to prepare. Let’s keep it REAL, if we don’t have a plan of what our money will do for us, we might not be responsible with how we use it. We recommend having the REAL budget plan with you at all times. You can keep it on your phone or in your wallet. Use it immediately after you’ve paid for something or when you get paid. Build a relationship with your budget plan and watch how your life changes for the better!

Spending REAL Money

Invest!

We embrace the idea of investing. We believe investing is when you put your resources into something to either grow that something or to grow the resources. With that said, investing is all about growth and not just about money. When you study, for example, you are making an investment. If we take the time to invest into our education and learning, we will grow. The same rule applies to money. You should invest your money into things that will either grow who you are or grow your money. Simple as that. Think about it. When you buy $300 Jays, what’s growing? If anything, it might be your shoe size; then the shoes won’t even fit! That same $300 can go into growth stocks (we recommend doing your research first!) or even a business you might be interested in starting. As we continue to say, money is a tool. It should be used that way. Just like a screwdriver to a wobbly chair, a tool is only valuable when it can improve something else.

Assets vs Liabilities

Investing is a nice segway into discussing the difference between Assets and Liabilities. Before we dive in, check out Robert Kiyosaki’s Rich Dad Poor Dad, where he gives a great description of Assets vs. Liabilities as well as so much more! Based on this book, we define assets as money-makers. Liabilities, then, are money-takers. Simple as that. One of the smartest things you can do financially is to ask yourself if you’re purchasing an asset or a liability with each purchase you make. Let’s keep it REAL, there are also those things we buy for ourselves after we’ve “made it”, like private jets and yachts. Those purposes should be the “end-goal purchases”, which are different from assets and liabilities. Another good idea would be to use the 24-hour rule, which is when you give yourself 24 hours before making a purchase. Not much will change in 24 hours, but you can use this time to figure out if the purchase is an asset or liability. You can also use this time to try to figure out how to turn it into an asset, which is usually possible.

If you’ve made it this far, you’re a REAL one! Thank you. We hope you got some value out of this post. Like we mentioned earlier, it’s a shame that people don’t discuss financial literacy more often. It can honestly help a lot of people. Always remember the purpose of your money. Always remember that your value is not measured by money. Never settle for less or sacrifice your value for money. Money is not meant to be chased; it’s meant to be used. Lastly, we will end with something we also mentioned earlier: Begin with the end goal in mind. A good time to start is NOW. Know that this journey is a marathon, so just take it one step at a time and eventually you will get to the finish line.

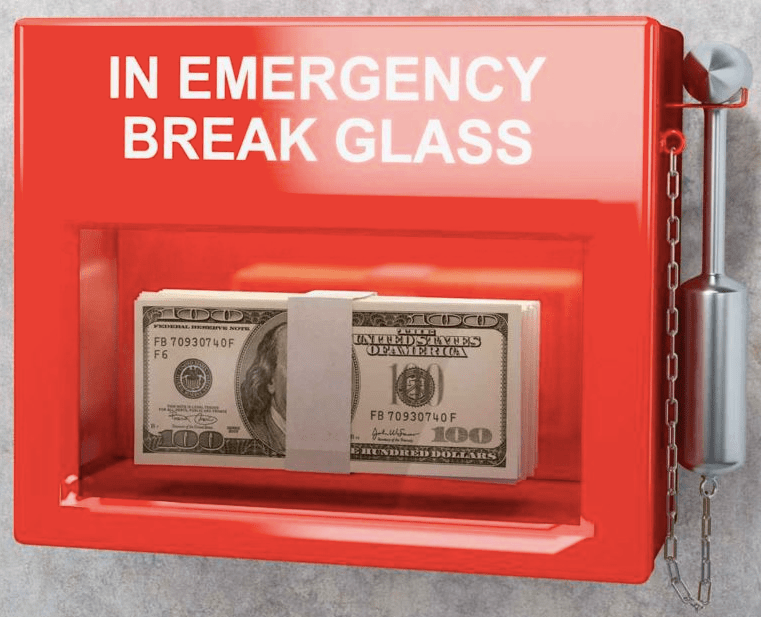

Bonus: REAL “Emerge-And-See” Fund

We just thought we would throw this in here as a bonus. We constantly preach preparing for the future, so it’s only right we bring up our “Emerge-And-See” Fund. This is a fund that adds up to a total of your expenses in a year. For example, if your REAL budget plan shows that you spend, on average, $1000 per month, then the fund should be $12,000 (12 months x $1000). This fund is only used when you can’t afford a necessary expense. “Emerge” literally means to move away from something to come into view. Think about firefighters coming out of a cloud of smoke with saved lives in their arms. This is basically what your fund is. This fund saves you when you need it the most.

Keep It REAL.